Getting Started in Crypto as Muslim

As an ethical investor, getting into Crypto can be a confusing landscape when asking yourself which aspects are Halal or Haram. In this…

As an ethical investor, getting into Crypto can be a confusing landscape when asking yourself which aspects are Halal or Haram. In this short article, we share a few widely accepted rulings into what parts of Crypto are/aren’t permissible in Shariah.

Firstly, not everything in crypto is a “token” — crypto is a broad term for any financial operations that happen on a blockchain. Solana, Ethereum, Bitcoin are all blockchains and coins independant of each other that can have many things built on them.

There can be memecoins, loans, leverage trading, stablecoins, real estate, and loads of other things that exist on-chain. So, when asking if crypto is Haram, there are many facets to look at.

Let’s look at each category in detail.

Disclaimer: In this article we just give general guiding principles. Before investing in particular products, we still advise running things by a scholar.

Coins & Tokens

Coins and tokens are the most well known aspect of crypto — Bitcoin, Ethereum, and Solana are all coins that have their own respective blockchain.

Bitcoin, Ethereum, and Solana are permissible under both the Hanafi and Maliki understanding because they are either permissible forms of money or seen as assets.

Neither money nor assets need to be physical in Shariah. Most dollars or fiat money are not physically present in majority currencies as well.

However, a major caveat with tokens beyond the major names Bitcoin, Ethereum, and Solana is to know what they represent and how they derive their value. Some tokens are representations of haram protocols such as lending or gambling.

Watch more here on the general permissibility of crypto.

Memecoins

Memecoins are tokens mostly traded on the Solana or Ethereum blockchain. An active area of research. Some scholars say they are generally permissible while other scholars say they are generally not permissible because of their iffy use cases and utility. Either way, they can and are often used as forms of payment, this we know. Because of this, it’s best to be involved in coins with no clear haram such as: pornographic/indecent images, affiliation to haram, perpetuation of haram, etc.

NFTs

NFTs are an interesting topic to discuss. In most madhabs, it’s widely recognized that art depicting humans is not permissible. So, if the images shown on an NFT are in any similar manner impermissible for the same reasons regular art is, one can say that those are not permissible either.

That being said, NFTs, similar to traditional art that simply depict non-human scenes are seen simply as digital art and are permissible. Using NFTs as proof of digital ownership is also seen as permissible.

On minting NFTs, some madhabs may have a problem if minted NFTs have an “unrevealed” aspect to them as this may contain gharar (read more on that here). One does not know for certain what they’re getting from an NFT mint nor do they know its value. There is some debate though; since NFTs always contain a floor pice, its minimum value can always be known and since a minter knows it is always receiving X amount of NFTs per mint, it may diminish the gharar of the contract. Allah knows best.

DeFi (Decentralized Finance)

DeFi is an incredibly lucrative way for investors to safely earn yield on their dormant assets. On first glance, earning 10–20% on your USDC/SOL seems like a great move, but when looking deeper, the Shariah compliance problem comes from where this yield is accrued.

Yield from most DeFi related protocols comes from lending for leverage trading or interest based loans. Sadly, this makes the majority of yield from these platforms Haram as well.

Some platforms offer yield from profit sharing such as Coinbase or Binance, these yields may be permissible. Further research is needed per instance.

Is my coin Haram? Is this coin permissible?

When asking this question, it needs to be understood that similar to other currencies, sometimes the time a coin itself is not the problem but rather the usage of them.

According to Shariah Solana, Bitcoin, Ethereum and many crypto themselves are not Haram but become a problem when used in Haram activities. For example, USD can be used to transact in grocery stores or for buying drugs. This decision is up to the user, not the currency.

In the case of gharar (غرر), or “increased uncertainty and risk”, an asset itself can not contain gharar, only a contract can when pertaining to [any] asset. So, Solana itself can not have gharar, only a contract containing uncertainty of the transaction utilizing Solana can.

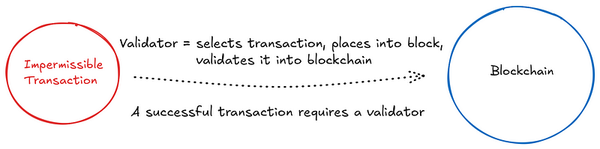

Impermissible

Utility coins that are attached to haram protocols may widely be seen as impermissible such as tokens that support:

1. Gambling protocols

2. Illegal/illicit activities

3. Porn/indecent photographs

4. Interest-Based Lending

5. Other Haram

Now that is understood, getting started in crypto only takes a few steps.

- Download an exchange app, like Coinbase/Binance or Robinhood and buy crypto.

- Send that Crypto, (mostly Solana for memecoins) to a **wallet** like [Phantom] (Solana/Ethereum/Bitcoin) (or buy Solana directly from there with Moonpay)

- Use the in-wallet interfaces to start trading!

- For memecoins, send those funds to a trading bot like BullX or Ape Pro. These platforms are made directly for trading and will help make your journey much easier than simply swapping via [Jupiter] on Phantom.

Learn more on Crypto 101 directly from Phantom’s help docs.

We hope this helps in understanding the basic permissibility of coins in crypto. If you have any questions, please leave DM us @inshallahfi or message us on Telegram.

Allah knows best and may he guide us all, inshAllah.