Goldsand: Halal ETH Staking Whitepaper

Islamic Finance is a $4T industry offering products such as zero interest loans and banking services, primarily in markets like MENA…

Goldsand: Halal Staking Whitepaper

Islamic Finance is a $4T industry offering products such as zero interest loans and banking services, primarily in markets like MENA, Southeast Asia, and South Asia. Despite being a relatively nascent industry (the first commercial islamic bank, Dubai Islamic Bank, was founded in 1975), islamic financial products serve more than a billion customers today.

InshAllah (the company behind Goldsand) aims to build the Decentralized Finance (DeFi) equivalent of a suite of programmable products for everyday consumers and institutions. Currently, options to invest within major blockchains like Bitcoin, Ethereum, and Solana in an Islamic finance-compatible way are minimal if not unavailable entirely. DeFi primitives like staking, RWAs (real-world assets), loans, and leverage are not designed to serve the $10B+ of crypto already held by customers that invest according to islamic finance principles. With time, the amount of assets held by this group has continued to grow year-over-year.

Decentralized islamic finance has the potential to go a step further than traditional islamic finance: while traditional Islamic finance aims to be zero interest, it is hampered by its almost complete reliance on the modern banking system — itself built entirely on interest (i.e. fractional reserve banking). Despite the incredible efforts of sincere bankers and scholars to break out of this reliance, traditional Islamic finance products are often forced to sacrifice profits, principles, or both. This has resulted in an overall Islamic finance industry yet to show its true ability to deliver high-performing, truly equitable and stable yields

Islamic DeFi, on the other hand, is an open play field, unconstrained by the arbitrary rules of Wall Street. The long term goal is to unlock an entirely new pool of capital that equally serves customers looking for fair & sustainable returns and business creatives who can dream up new ways to deliver those returns.

Introduction

InshAllah is being built: (1) to bring foundational crypto tooling to nearly 2 billion Muslims, (2) accessible to their languages and principles, and while (3) providing a way out of the inflation/interest trap.

Bitcoin, Ethereum, Solana, and many other cryptocurrencies already enable several use cases towards these goals: frictionless cross-border payments, decentralized applications, decentralized finance (DeFi) and decentralized infrastructure (DePIN), to name a few.

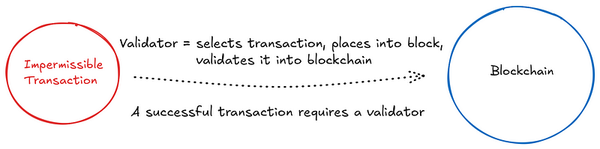

However, at the core of these blockchains are the mechanisms that power them. In particular, with Ethereum and Solana, any person can contribute to the network by “reinvesting” through a process called staking. Staking powers the computers that run the blockchain networks and their underlying transactions, while giving yield (a reward for participation) to the stakers. Unfortunately, many of these transactions and applications running on these blockchains involve interest, gambling or other impermissible activities from an Islamic point of view.

What is Staking?

Before we dive into the details of the Goldsand product and how it makes staking halal, it’s necessary to explain the basics of staking. Experienced crypto users who are familiar with this topic can skip this section.

Every cryptocurrency network needs a mechanism to confirm transactions on the network and extend the network’s blockchain with valid blocks. Bitcoin and Ethereum (in its early days) used a mechanism called Proof of Work (PoW). In this mechanism, specific network nodes (referred to as miners), use significant computing power to earn the right to build a new block on the network. In September 2022, Ethereum changed the mechanism it uses from PoW to Proof of Stake (PoS). In PoS, users on the Ethereum network compete to earn the right of building blocks by locking their ETH in a special smart contract. The more ETH a user locks, the more likely they get a chance to build a block on the network. This activity is called staking.

Nodes that perform the staking activity are called validator nodes. An Ethereum user can run a validator node by locking 32 ETH and running special software to build and validate new Ethereum blocks. These nodes are rewarded for building & validating blocks which generates staking yield on the locked ETH.

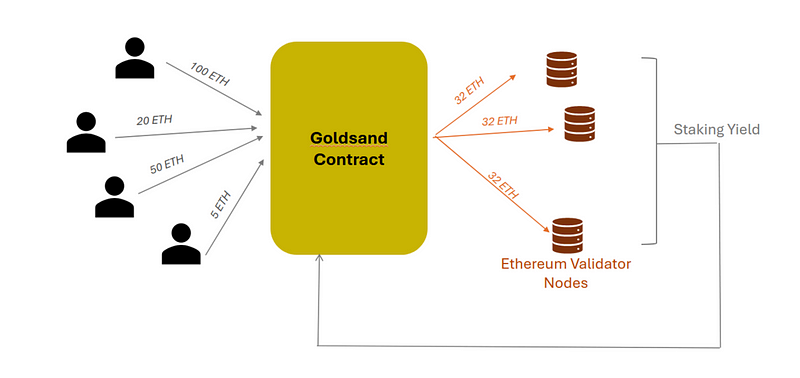

As most users don’t have 32 ETH to run their own validator node, protocols such as Lido collect small ETH deposits from users to launch validator nodes on their behalf. For every 32 ETH of deposits, the protocol launches a new validator node. The earned rewards from all the validator nodes are shared proportionally between the depositors.

When a validator node is selected to build a block, the node collects new transactions and combines them to propose a new block. The validator node can delegate the task of choosing the transactions in a block to a different entity called a “Builder.” This mechanism is called Proposer Builder Separation (PBS). When a new block is proposed by a validator, other validator nodes inspect the block and validate its correctness.

Issues with Existing Staking Solutions

The current Ethereum staking setup is not 100% halal or at least not 100% pure 1 . The reason is pretty simple: all existing staking protocols don’t differentiate between different transaction types. That means that these blocks could include haram transactions. In fact, between 80 and 90% of the blocks produced by current Ethereum validators include at least one interest-based transaction from applications such as Aave, Compound, or other lending applications. In these lending protocols, users borrow money and pay interest on these loans. As interest is impermissible, such lending transactions are impermissible. Existing staking protocols, e.g., Lido, include such impermissible transactions in their blocks by default. Hence, staking ETH with these protocols empowers impermissible transactions and benefits from their fees. This contaminates the yield generated for such staking operations.

In short, the yield earned on staked ETH today includes yield from validating interest-based transactions.

Goldsand Solution

Goldsand is a halal Lido alternative. It is an Ethereum staking product that avoids interest (riba) and maximizes yield.

Goldsand is an integrated solution that combines a customized block builder and a network of validator nodes to implement a halal staking solution. Our network of validators earn competitive, stable ETH yield without compromising on the principles of islamic finance.

When users stake their ETH with Goldsand, the ETH is exclusively used by validators that propose blocks intentionally excluding all interest-based transactions. The Halal staking works without compromising on any yield when compared to other leading staking providers.

Is staking that important though?

Ethereum staking is one of the most stable forms of yield in the world.

Since its release in late 2021, Ethereum staking has consistently yielded more than 3% APY year-over-year. And unlike Treasury bills, where stable (and “guaranteed”) yield comes from interest, Ethereum staking yield comes from partaking in the Ethereum validation and security service. The aggregate ETH staked from all validators is a public good for the Ethereum blockchain.

Hence, staking is a critical means of stable, productive income. But as a Muslim user, you are left with one of two choices — stake with validators that earn money from promoting interest or miss out on one of the most stable yields in crypto.

Goldsand lifts this dilemma for conscientious users by generating a stable yield from providing a valuable service while avoiding income from interest-related transactions.

Technical Implementation

On a technical level, the Goldsand protocol implementation has many similarities to existing staking protocols such as Lido. Goldsand implements a set of smart contracts on the Ethereum L1 that accepts ETH deposits from users. When the total amount of deposited ETH reaches a minimum of 32 ETH, the smart contract triggers a process that launches a new validator node. The launched validator is registered on the Beacon Chain.

When the validator nodes become active, they perform two functions that earn rewards from the network: (1) proposing blocks and (2) generating attestations.

The earned rewards from all of the validators are distributed to the users proportionally to their share of the deposit.

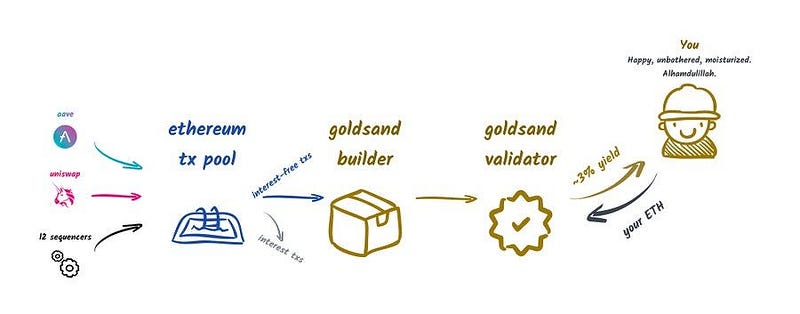

The key differentiation in Goldsand’s architecture is the unique block-proposing mechanism. When any of the Goldsand validator nodes is selected, the validator node proposes a block that excludes any impermissible transactions. This is done through a proprietary builder architecture.

For the builder, we both run our dedicated builder infrastructure and also collaborate with some of the leading builders on the ETH L1 network. Integration with external builders allows Goldsand to tap into proprietary order flow (i.e. private transactions and transaction bundles). In both cases, the transaction filtering rules are strictly applied. For transaction filtering, Goldsand maintains a list of impermissible applications and smart contracts. This list is actively maintained in consultation with our shar’ia shariah board. Transactions involving these smart contracts will be filtered out and ignored. At each block proposing slot, multiple block candidates are created and passed to the selected Goldsand validator. The selected validator selects one of these blocks to sign and propose to the network.

The other job that validator nodes perform is attestation. Attestations are necessary to ensure the progression of the chain. During attestation, the node declares to the network the most recent block the node has observed.

Based on the aggregated views of all reported attestations, the network accepts the proposed block and adds it to the canonical chain. Attestation is a critical task and validator nodes that don’t provide attestations get penalized by deducting from the node’s ETH balance.

Future Products

The InshAllah Network suite of Halal DeFi products is just the beginning. Goldsand Halal Staking is our first foray in this exciting and growing space.

InshAllah Network aims to bring cutting-edge islamic finance products to Muslims built on crypto rails. Goldsand Halal staking is the very first project.

V1 is the first iteration of Goldsand. In later versions, we would like to explore several avenues, including:

- Expanding Goldsand to other networks such as Solana and Bitcoin L2s

- Supporting an LST for halal restaking

Beyond these expansions, InshAllah Network is planning several products, one such being a halal yield-bearing stablecoin. Details of these projects will be shared with our community in the future

FAQs

Can staking deposits be withdrawn?

Yes, staking deposits can be withdrawn by submitting a withdrawal request on the frontend of the Goldsand project. The withdrawal requests typically incur a delay (around a few days) that is defined by the Ethereum network. In the early phase of the project, processing withdrawal requests will be limited until the public launch of the product.

Who runs the validator nodes?

Goldsand validator nodes will be either operated by the Goldsand team or by professional node operator partners who are thoroughly vetted by the team based on up-time and infrastructure robustness. The list of node operators we partner with will be public on our website and communication channels.

Is there a Liquid Staking Token?

We plan to have a liquid staking token (LST) soon after the early deposit phase. In this version of Goldsand, there is no LST unfortunately.

Is there a native token for the project?

Currently, there are no plans for a native protocol token. We are continuously evaluating the ways how a native token can add value to the products we launch. If a token launch is decided in the future, the information will be shared with our community and the public.

Is there an incentive for early users?

Early adopters are critical for every product. They add immense value by using the product, providing feedback, and promoting it to their network. The contribution of our early adopters cannot go unrewarded. We plan to offer a suite of incentives to early adopters, including: zero fees, enhanced yield, referral rewards for users who promote the protocol, and much more. Just as a disclosure, InshAllah Network has the sole discretion to designate who qualifies as an early depositor.

© 2024 InshAllah Network