Insurance: Haram or Not?

Insurance such as home, life, health, or car insurance is a risk management system in which users can derisk their uncertainty of…

Insurance such as home, life, health, or car insurance is a risk management system in which users can derisk their uncertainty of calamities by providing planned techniques that help financially cushion them.

Insurance has been around for decades and is brilliant investment to make to save oneself from unfortunate accidents, but looking closer at its Shariah Compliance, there may be some issues.

In Islamic Finance, basic things we all know like interest and gambling make many lucrative financial instruments haram. In the case of insurance, there is one main one that scholars agree may make insurance haram:

Gharar

Gharar is defined as something that is associated with uncertainty, deception, and risk. Gharar is present when the presence or existence of the object of the transaction is unknown.

In the case of insurance, gharar is present because insurance is predicated on an event that may not occur at all. If one gets into a car accident, if one has a health issue, if one’s roof of their home breaks. This makes your installments pay for something that may not ever exist (inshAllah).

This is similar to the gharar being present in sales contracts where the owner does not own the product they are selling such as a fisherman selling fish he has yet to catch or attempting to sell a bird in the sky.

Well, ok. Insurance is Haram. What now? Do I just cancel all my insurances and live life uninsured?

Scholars agree that since insurance is legally mandated in many countries and there are no Islamic alternatives available (such as Takaful), insurance is seen as tolerable. Some see it as gharar yasir, or a form of gharar that is small enough to be allowed.

This ruling is given following the near necessity of insurance in modern times and overwhelming negative repercussions for those who attempt to go about with insurance.

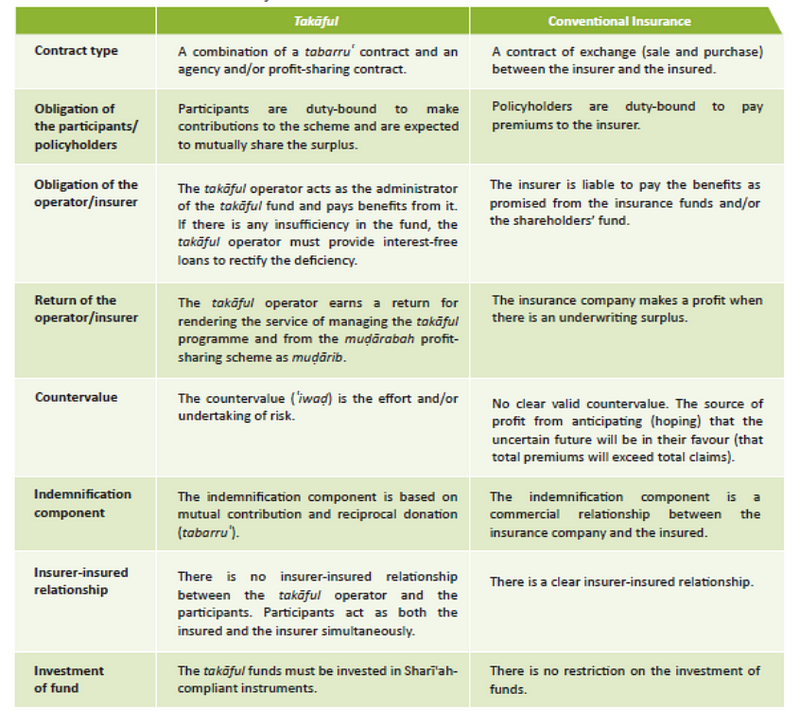

Takaful (التكافل) is halal insurance alternative where people put money into a pool and are then able to access these funds if one the contributors need it. These contributions are seen as charity (as lending is usually in Islam) rather than a legally binding necessity to do so. When contributors to a Takaful pool donate said money, the contract changes from a for-profit one created by insurances to a mutually beneficial one between participants.

With crypto, Takaful is much easier as it can be universally accessed around the world. These solutions exist on-chain such as Takadao, a decentralized protocol that offers life [and soon] health, and home insurance with crypto.

Conclusion

If you can use Takaful as insurance, you should. But if there are no Halal alternatives, then traditional insurances are seen as tolerable by necessity.