Is Staking Yield Riba or Interest?

Many Muslims ask whether crypto staking is halal or haram. We explain how staking works, why it’s not the same as riba, and what makes staking shariah-compliant.

While many Muslims exploring crypto ask the same question: “Is staking halal or haram?”, others ask more pointed questions on the nature of staking itself, like “is staking riba” or “is staking just like interest?”. These are important questions because, for staking to be halal, it must avoid both riba (usury/interest) and haram income streams.

Below we share a real question we received, along with our detailed answer.

The Question

“I went to your website and tried to understand the structure and source of profit, but it seems you are getting yield for staking directly. Isn't this riba?”

The Answer

Salaam. Let’s carefully consider how staking actually works.

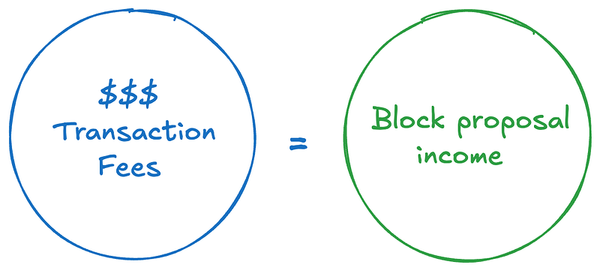

When you stake, you give some of your capital to a validator. The validator uses that capital to propose and verify blocks on the blockchain. This is real economic work, as block validation requires computation, security provision, and uptime.

The validator earns profits from this work, and those profits are then split between the validator and the depositor. In Islamic finance terms, this resembles qirad (mudarabah):

- Capital from the investor

- Work from the validator

- Profit shared between them

This structure is fundamentally different from lending with interest, which is what defines riba.

Real World Example

Think of it like this:

You have some capital, and your friend owns a taxi but needs fuel money. You provide the fuel, and your friend drives passengers around. At the end of the day, the earnings are shared between you (the one who provided the capital) and your friend (the one who did the work).

- This is mudarabah/qirad: one side provides money, the other provides effort, and profit is shared.

- It is not riba, because your return is not guaranteed. It depends on real work and actual passengers.

Staking works the same way:

- You provide capital (crypto)

- The validator does the work (securing the network, proposing blocks)

- Rewards are shared

- Return isn't guaranteed

- Depends on the validator actually doing their job

- If validator fails (downtime, slashing) you may lose some of your stake and potential return

- Even if things go smoothly, the reward rate is variable depending on network conditions (how many people are staking, transaction fees in blocks, etc.)

The key difference from riba is that the validator is not paying you a fixed return on a loan. Instead, you are entering a partnership where profit depends on work and risk.

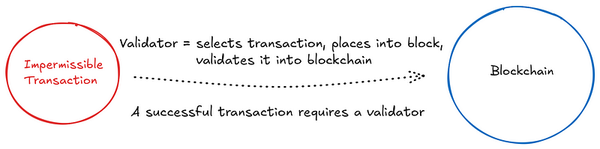

The Real Issue: What’s Inside the Blocks?

While the structure is halal in principle, there is a secondary issue: some of the transactions inside the proposed blocks may involve:

- Interest-bearing lending

- Leverage

- Gambling

If left unfiltered, some of your staking rewards could be sourced from haram transactions. That’s the critical concern, as earning returns through validating haram transactions can be seen as impermissible income.

How We Solve This

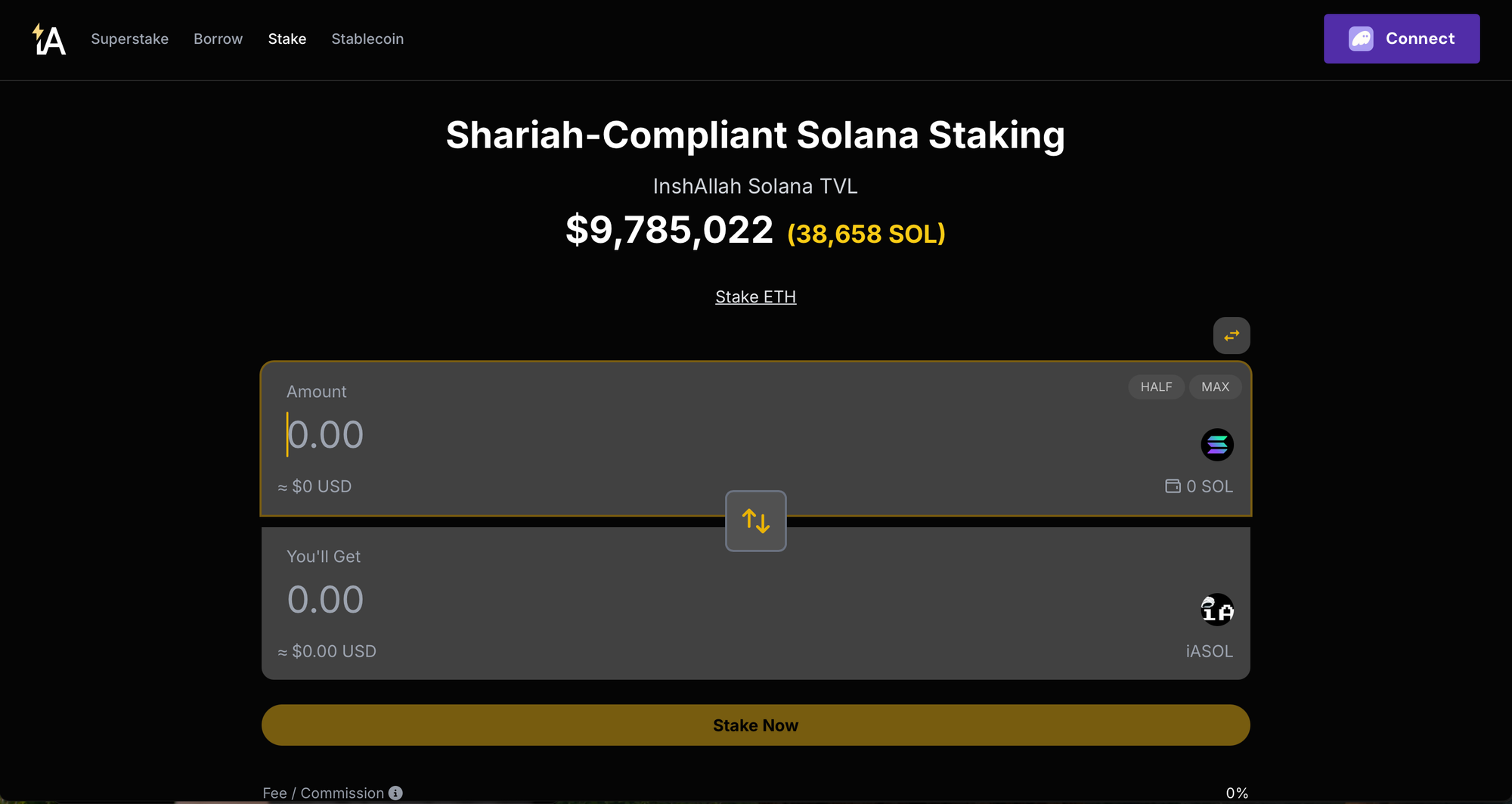

inshAllah Finance has developed a framework for shariah-compliant Solana and Ethereum staking by:

- Screening and filtering blocks to remove haram sources of profit

- Ensuring only shariah-compliant transactions contribute to staking rewards

- Publishing in-depth, peer-reviewed research so the community can verify the process

You can use our Shariah-compliant staking validators and start earning halal yield on your Solana and Ethereum.

Conclusion

So, is staking halal?

- In structure: yes, because it is closer to mudarabah than riba.

- In practice: it depends on whether haram transactions are filtered out of the blocks being validated.

inshAllah's validators ensures that staking income is purified and compliant with Islamic finance principles.

If you’re looking for clarity on staking, remember: the key isn’t whether staking “looks like interest,” but where the profit actually comes from.