Leverage Trading: Why do most scholars agree it is Haram?

Leverage trading is when one borrows capital and uses it to long or short assets. This is usually the way most traders in crypto trade and…

Leverage trading is when one borrows capital and uses it to long or short assets. This is usually the way most traders in crypto trade and can be a risky yet highly profitable way to amplify traders that may not have high capital to risk in trades.

The main Haram comes from Riba (usury/interest). This is widely known as “Margin”; you’ve probably seen this when opening accounts on trading platforms whether with stocks or crypto.

Margin has a rate of interest that capital is borrowed with. This is clearly interest and is not permissible in any manner in Islam.

Although it’s been pretty normalized due to the inability of avoiding it (sadly), Riba is one of the worser Harams a Muslim can engage in. (3*)

- Even during times where platforms have negative interest, scholars agree that leverage trading is still Haram due to said platform still benefiting from increased volume and profit from said promotions. (2*)

Options fall under this category as well but in a different manner.

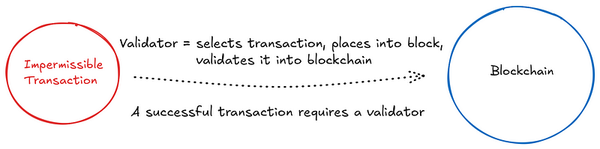

The option instrument is not halal because the option writer charges a separate fee for the option, and at the time of writing that option, the writer does not own the underlying asset.

However, when it comes to the trading of such options, regardless of whether it is a conventional option or a halal option, both cannot be traded. Simply because in Islamic law, an option cannot be a subject matter of a sale contract. Meaning that Shariah does not recognize such a right (to buy or sell) that can be considered a valid asset in itself. Therefore, its trading is also not allowed.

That being said, don’t let this discourage you from investing. Many other forms of trading be it stocks, cryptos, commodities, etc are still Halal and permissible to be invested in.

We of course urge the Ummah to look into Crypto, especially BTC/ETH/SOL/USDT.

So, although leverage trading is a very lucrative and exciting way for crypto traders to amplify their trading experiences with, it’s ruling is impermissible in Islam due to its usage of Margin (riba) and the buying/selling of assets one does not own.

Sources:

1. Narrated Hakim ibn Hizam: Hakim asked (the Prophet): Messenger of Allah, a man comes to me and wants me to sell him something which is not in my possession. Should I buy it for him from the market? He replied: Do not sell what you do not possess. (Sunan Abi Dawud 3503 Book 24, Hadith 88)

2. Jaabir said: The Messenger of Allah (PBUH) cursed the one who consumes riba and the one who pays it, the one who writes it down and the two who witness it, and he said: they are all the same. (Muslim 1598)

3. Narrated ‘Ali (RA): Allah’s Messenger (ﷺ) said: “Every loan, which leads to a benefit, is usury.” [al-Harith bin Abu Usamah reported it, but its chain of narrators is Saaqit].

4. As usual, please do more research on your own.

Written by Haarith Bin Sulaimaan (inshAllah team) with consultation and input from Sh Farrukh Habib